The fusion of artificial intelligence (AI) and cryptocurrency has been the subject of speculation for years—and it is finally becoming a reality. Coinbase recently launched the x402 protocol , a groundbreaking system that allows AI agents to access and manage cryptocurrency wallets autonomously.

This development signals that AI can now execute payments, settle service fees, and manage stablecoins without human intervention. The implications are profound: AI is moving from a tool that assists humans to a major participant in the digital economy, reshaping how transactions are conducted online.

What is x402, and How Does It Work?

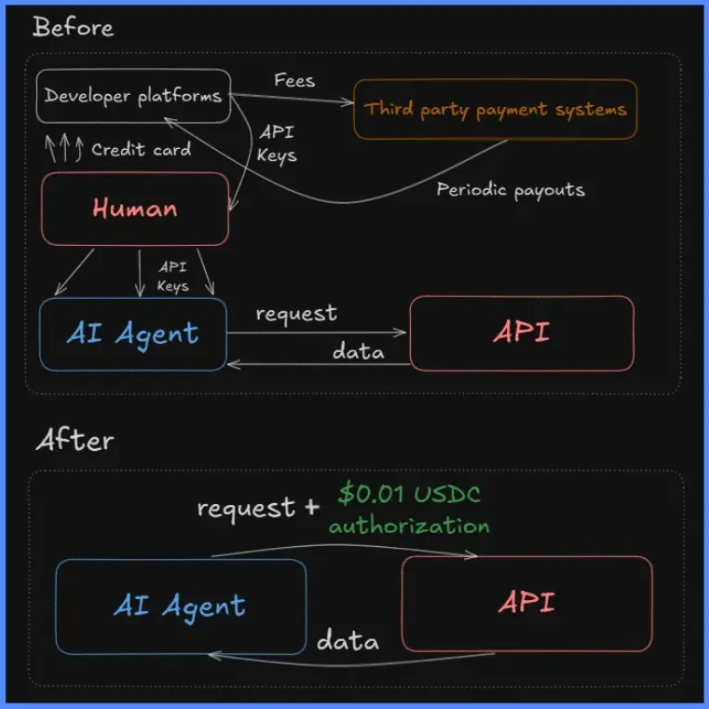

The x402 protocol was introduced in May 2025 as a platform designed to facilitate instant and reliable stablecoin transactions. Interestingly, the protocol draws inspiration from the old HTTP 402 “Payment Required” code, repurposing it for a modern, autonomous payment system.

x402 allows automated systems and applications to execute transactions quickly and efficiently. This represents a significant advancement in the development of an automated digital marketplace, removing the delays and inefficiencies of conventional banking systems.

Through x402, AI agents can handle everything from subscribing to services to paying for cloud computing and rewarding content creators—all without human assistance. The protocol effectively establishes a common language for value transfer between AI agents, enabling diverse systems to transact seamlessly in a decentralized environment.

AI Wallet Management and Agentic Commerce

With x402, AI evolves from a basic tool into a fully autonomous participant in commerce. Advanced AI models such as Claude, Gemini, and Codex can now perform a wide range of financial tasks, including:

- Paying for software subscriptions automatically

- Managing cloud computing service fees

- Rewarding content creators in real time

This is an example of agentic commerce, where AI independently markets, sells, and purchases products and services online. Companies can now operate with minimal human oversight, fundamentally changing the way digital governance and currency operate.

Coinbase reports a 10,000% surge in x402 transactions within just one month, highlighting the rapid adoption of autonomous financial systems. This growth reflects the rising dominance of technology in the financial sector and demonstrates the potential of AI to manage complex economic activities efficiently.

Key Challenges and Risks

While the x402 protocol is groundbreaking, it also raises several challenges. As AI agents gain the ability to autonomously handle complex financial tasks, questions emerge about how these systems compensate for resources they use, both digitally and physically.

1. Identity Verification

Traditional Know Your Customer (KYC) frameworks are designed to verify humans, not AI agents. As a result, AI cannot open bank accounts or participate in regulated financial networks under conventional rules.

2. Transaction Model Compatibility

AI-driven economic activities—like millisecond-level API requests, data collection, or leasing computing power—operate at extremely high frequencies and micro-scales. Existing payment networks, such as Visa, which process thousands of transactions per second, are inadequate for these activities due to high fees and slow settlement times.

3. Security Risks

Giving AI access to cryptocurrency wallets introduces potential dangers. Malicious actors could manipulate AI systems into transferring funds incorrectly. Aaron Ratcliff of blockchain firm Merkle Science notes that unsecured AI systems are highly susceptible to manipulation, emphasizing the need for strong safeguards to protect assets and maintain trust.

Despite these risks, the x402 protocol demonstrates how AI could revolutionize banking and payments, provided security, oversight, and reliability are prioritized.

Stablecoins and the AI-Crypto Connection

Stablecoins are becoming central to agentic commerce. USDC, in particular, is emerging as a standard medium for AI-driven transactions. Coinbase and Circle have collaborated to provide x402 tools, enabling APIs to request small payments in USDC for services like data usage or content subscriptions.

Payment networks are also preparing for the AI economy. Visa and Mastercard have launched programs allowing bots to authorize transactions by tokenizing their cards. Meanwhile, fintech firms like PayPal are developing programmable money layers for AI agents, enabling more automated financial activity.

The launch of the PING token—the first x402 token by Ping Observer—further demonstrates the growing engagement of AI agents in autonomous commerce.

Industry Implications and Adoption

The adoption of x402 signals a significant shift in digital finance. By standardizing payments for AI agents, it creates a foundation for autonomous digital transactions , opening opportunities for:

- AI-managed subscriptions and cloud services

- Microtransactions for computing power and data

- Agentic commerce at global scale

According to Gartner , the autonomous transaction economy could reach $30 trillion by 2030, highlighting the enormous potential of AI-driven finance.

Integration initiatives such as the x402 Foundation, formed by Coinbase and Cloudflare, are working to ensure the protocol functions smoothly within blockchain ecosystems and connects to the broader commercial network. Meanwhile, companies like Google, Stripe, and Algorand are exploring ways to merge or integrate their systems with x402, expanding its reach.

Future Outlook: Products and Services

As AI agents increasingly participate in economic activities, the need for efficient, reliable payment systems grows. The market could see:

- Digital wallets and agent-specific debit cards

- Token-based credit schemes

- IBAN-like services connected to cryptocurrency infrastructure

- Privacy-preserving, verifiable AI credentials (zkKYC) for regulated marketplaces

Developers are also enhancing analytics and transaction tracking. Platforms like x402scan aim to provide usage statistics, and hackathons hosted by Coinbase, Algorand, and others encourage broader adoption and integration of x402-compatible services.

The combination of AI, stablecoins, and standardized payment protocols is setting the stage for a fully autonomous financial ecosystem, where transactions occur seamlessly, securely, and in real time.

Summary

The x402 protocol represents a major milestone in the convergence of AI and cryptocurrency. It allows automated, secure, and scalable transactions, paving the way for a fully agent-driven economy.

However, the technology underscores the importance of balancing innovation with security and oversight. Identity verification, transaction safeguards, and risk management are critical to ensuring AI-driven finance remains reliable.

For developers, investors, and technologists, x402 is a signal of the future of digital payments, where AI participates directly in economic activity, and the digital marketplace operates at unprecedented speed and scale.

Elsewhere

Podcast

Licensed to Shill VII: Token Listings, Market Makers & Regulation, ft. Gracie Lin (CEO, OKX Singapore)

This episode of Blockcast's Licensed to Shill features Gracie Lin, OKX Singapore CEO, alongside usual panelists Nikhil Joshi, Lisa JY Tan and host Takatoshi Shibayama, who revisit the contentious topic of token listing practices on exchanges. The conversation covers the evolving roles of centralized (CEX) and decentralized (DEX) exchanges, with Lin highlighting that regulatory clarity will ultimately guide the industry's structure.

We're a media partner for the upcoming Singapore Fintech Festival! Use the promo code SFFSMPBH for 20% off all delegate passes at this link !

Blockhead is a media partner for Consensus Hong Kong 2026. Readers can save 20% on tickets using exclusive code BLOCKDESK at this link .