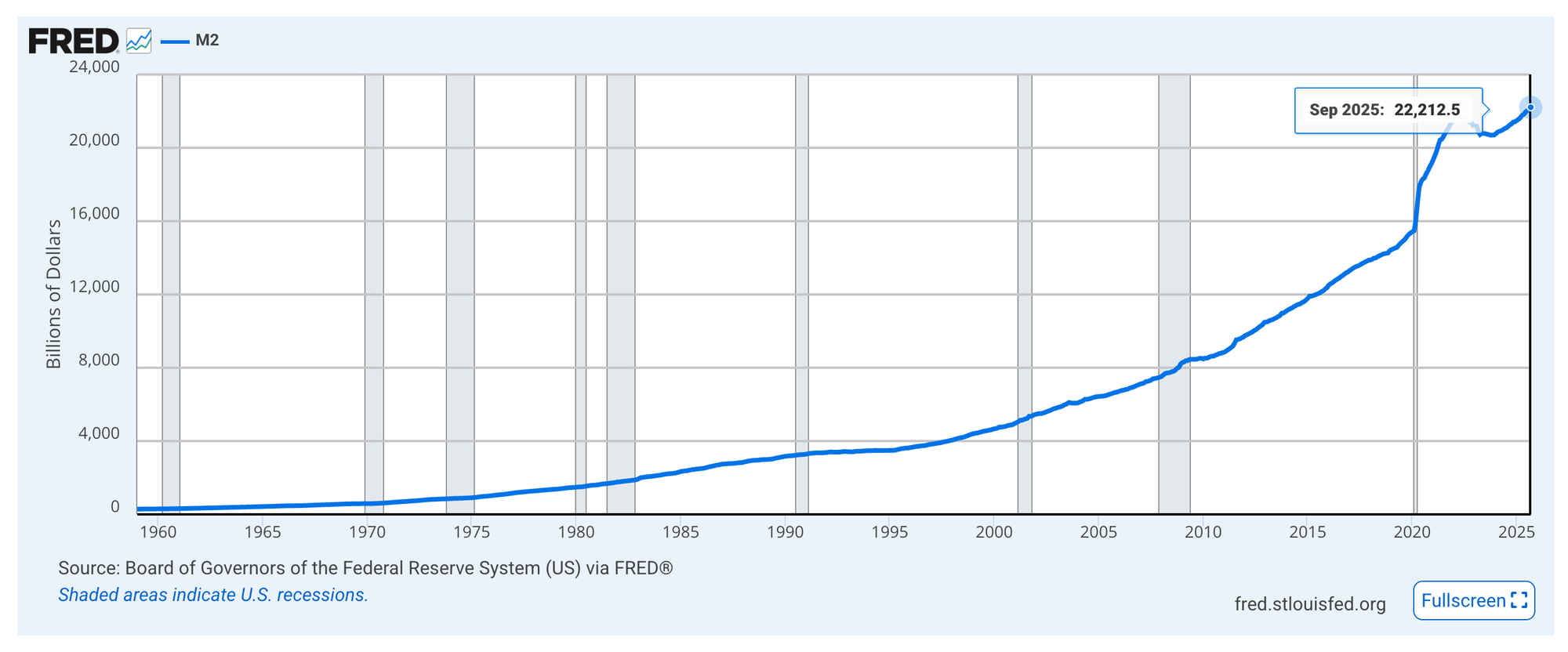

In September, the US money supply (M2) reached a record of $22.2 trillion, a rise of 4.5% from a year ago, marking an increase for the 19th consecutive month.

The long-term average growth rate, on the other hand, is 6.3%. After adjusting for inflation, M2 grew 1.4% in September, continuing a 13-month uptrend.

Market participants are closely monitoring M2 money supply trends and their potential influence on Bitcoin as global liquidity conditions shift once more.

The recent alignment of gold and Bitcoin with rising liquidity highlights the resurgence of the correlation between the money supply and Bitcoin price movements as a significant indicator.

In addition, China's market deluge and the Federal Reserve's $29 billion injection, Bitcoin is targeting the liquidity surge.

An unprecedented $29.4 billion was pumped into the US financial system on Friday by the Fed through overnight repo operations, the biggest single-day intervention since the dot-com boom. The People's Bank of China also injected enormous amounts of capital into the country's banking system at the same time.

Bitcoin and other global risk assets are at a crossroads, as shown by the recent synchronized liquidity measures.

To maintain market stability in the years leading up to 2026, market participants are watching central banks' liquidity moves closely. Significant sell-offs in Treasury securities, signaling increased pressure within the short-term credit markets, prompted the recent big overnight repo operation by the Fed.

Even when market liquidity is tight, institutions can still access funds quickly through overnight repos, which let them trade securities for cash.

By exceeding even the peak of the dot-com bubble era, the injection on October 31 set a record not witnessed in decades.

Many industry watchers see this move as the government's final response to strains in the Treasury markets. The Fed often steps in to reduce systemic concerns when bond rates and financing costs rise.

The expansion of the money supply, resulting from these interventions, is a typical characteristic of rallies in risk assets such as Bitcoin.

So, despite the bearish moves in recent weeks, cryptos could see a boost from the increased money supply.

Bitcoin & M2 Supply Correlation

During 2014 and 2015, the expansion of the M2 money supply showed signs of stagnation or a downward trend.

That decline corresponded with the drop in Bitcoin values, underscoring the negative impact of reduced liquidity on BTC's market behavior.

As the global money supply contracted, the demand for risk assets like Bitcoin decreased, leading to a bear market that was later succeeded by a phase of market consolidation until 2016.

During 2016 and 2018, the expansion of M2 maintained a consistent trajectory.

The recovery in BTC’s price, coinciding with positive M2 growth, reinforced the notion that a rising money supply creates a conducive atmosphere for Bitcoin price growth, which was followed by a brief correction into 2019.

During 2020 and 2021, the COVID-19 pandemic led the US Fed to cut interest rates from 2% to 0% and introduce an extraordinary level of liquidity into the global economy.

The swift growth of M2 during this period aligned with one of Bitcoin’s most significant bull markets, as market participants turned to it as a safeguard against inflation and currency depreciation.

During 2023 and 2024, with monetary conditions stabilizing, the growth of M2 leveled off, and Bitcoin prices entered a phase of consolidation characterized by minimal volatility.

Fed boss Jerome Powell’s comments at Jackson Hole indicated the possibility of rate cuts .

As we approach the end of 2025, will Bitcoin demonstrate a resurgence in strength, coinciding with the expansion of M2?

In line with the previous phase of consolidation, BTC is currently underperforming traditional safe havens such as gold.

But bets indicate that we might be on the brink of a new liquidity-driven cycle.

This emerging trend is consistent with historical patterns that frequently signal the potential for more prolonged upward movement in crypto markets.

In a recent

YouTube video, macro investor Raoul Pal

outlined that this particular environment signifies the beginning of what he refers to as “The Banana Zone” — a stage where liquidity resurfaces and crypto markets start to ascend once more.

Driving In the Fog?

Recently, Fed Governor Christopher Waller advocated for a reduction in interest rates come December, suggesting a possible move towards a more supportive policy stance.

This stands in stark contrast to previous assertive statements from Fed Chair Jerome Powell, whose cautious tone contributed to market volatility.

Recent data indicate that the likelihood of a third rate cut in 2025 has decreased to 65%, down from 90%, reflecting changing expectations regarding monetary policy.

The markets might take a nosedive if the Fed doesn't deliver on these expectations.

Market players have already priced in a more accommodating policy posture, so any change in this direction would cause them to pull money out of riskier investments.

The complex relationship between interest rate strategies, liquidity measures, and monetary policy highlights the difficulty the central bank has in balancing inflation and maintaining financial stability.

China’s Record Cash Infusion

To counteract falling demand and boost economic growth, China's central bank has injected record amounts of money into local banks.

The People's Bank of China (PBOC) has taken additional liquidity precautions to forestall credit tightening and maintain robust lending. As a part of its strategy to combat deflation and a faltering property market, Beijing has taken this step.

In line with its past reactions to such crises, the PBOC has taken action of a substantial magnitude. The goal of the central bank's additional funding is to lower borrowing costs and promote credit expansion.

A rise in asset prices, especially for equities and cryptos, might result from an increase in the worldwide money supply brought about by this sort of stimulus.

Investors may seek out alternative assets that offer protection against currency devaluation due to increased liquidity, which market participants are seeing as a similar trend.

The current situation is being described by experts as a "liquidity tug-of-war" between Beijing and Washington.

Inflation management and financial stability are two of the Fed's primary goals, while the People's Bank of China aims to promote economic growth without adding to the country's debt.

The outcome will determine the basis for asset performance in the dying months of 2025 and have an effect on risk tolerance.

Liquidity & Bitcoin Bets

As investors consider the repercussions of policy decisions by central banks, the price of Bitcoin has languished within a narrow range over the past few weeks.

Open interest in the top crypto has dropped from over 100,000 contracts in October to around 90,000 in early November, according to data from Coinglass, suggesting that the market is showing some signs of stabilization.

This drop also shows that derivatives traders are being careful.

If global liquidity continues to rise, the situation may still become advantageous for Bitcoin, even with low activity.

Increases in both the money supply and the rate of inflation in the United States have led to a loosening of investment restrictions.

Bitcoin is being seen by many large-scale investors as a stable asset, especially during periods of rapid monetary growth that threaten the value of traditional fiat currencies.

However, central banks' actions may have an impact on the dramatic increase in Bitcoin's value.

Any gains might be quickly erased if the central bank implements unanticipated rate hikes or scales back repo operations, both of which would compress liquidity.

Similarly, speculative assets could be hit if global risk sentiment drops because China's stimulus hasn't revived its economy.

Inflation management or further liquidity assistance from the monetary authorities will be the focus of attention in the coming weeks.

The outcome for Bitcoin might decide if 2026 brings about a major bull market or just prolongs the current consolidation phase.

Elsewhere

Podcast

Licensed to Shill VII: Token Listings, Market Makers & Regulation, ft. Gracie Lin (CEO, OKX Singapore)

This episode of Blockcast's Licensed to Shill features Gracie Lin, OKX Singapore CEO, alongside usual panelists Nikhil Joshi, Lisa JY Tan and host Takatoshi Shibayama, who revisit the contentious topic of token listing practices on exchanges. The conversation covers the evolving roles of centralized (CEX) and decentralized (DEX) exchanges, with Lin highlighting that regulatory clarity will ultimately guide the industry's structure.

We're a media partner for the upcoming Singapore Fintech Festival! Use the promo code SFFSMPBH for 20% off all delegate passes at this link !

Blockhead is a media partner for Consensus Hong Kong 2026. Readers can save 20% on tickets using exclusive code BLOCKDESK at this link .