What to Know:

- Bitcoin Hyper uses a modular Bitcoin L1 + SVM L2 design to deliver high-speed, low-fee smart contracts secured by Bitcoin settlement.

- Presale-stage projects like Bitcoin Hyper and PEPENODE offer high-beta upside if whale-led Bitcoin accumulation evolves into a full risk-on altcoin cycle.

- PEPENODE’s mine-to-earn concept and tiered virtual node rewards add a game layer to the memecoin thesis ahead of the next meme rotation.

- Shiba Inu’s Shibarium, ecosystem tokens, and ETF inclusion show how meme-origin assets can evolve into institutional-facing Web3 platforms.

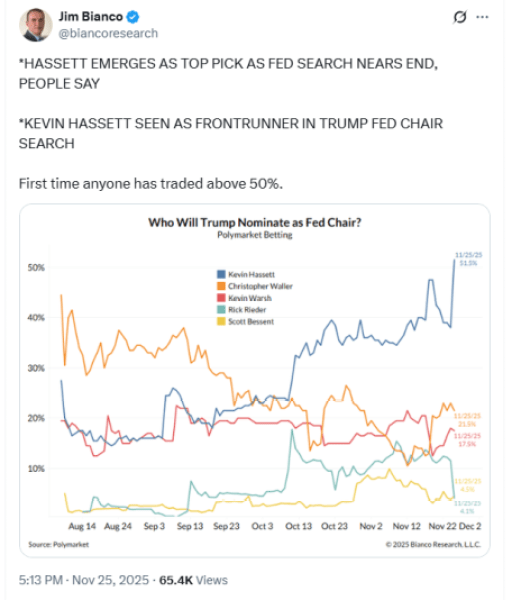

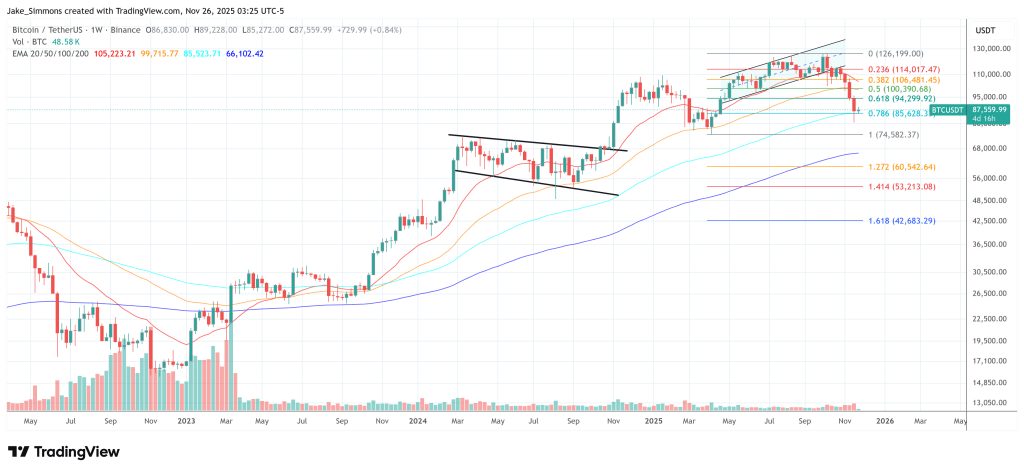

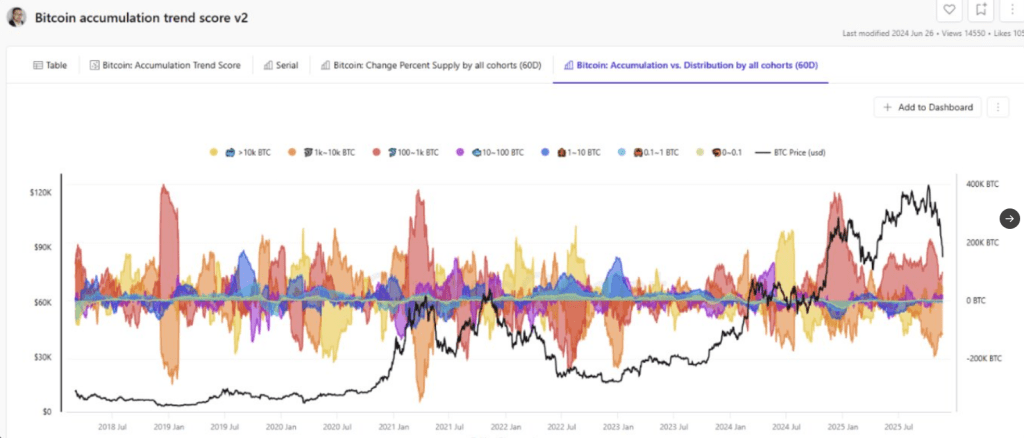

Bitcoin whales just injected more than $2B into fresh BTC exposure, a bold move at a time when retail traders are still de-risking after months of chop, liquidations, and sideways boredom.

For deep-pocketed players, this combination of capitulation and discounted pricing is exactly when the risk-reward flips back toward accumulation.

We’re witnessing a notable divergence: smaller wallets are continuing to step back from spot and derivatives markets, while large addresses are quietly scaling in, and ETF flows are showing early signs of stabilizing.

Historically, that rotation has preceded some of Bitcoin’s sharpest recovery phases, driven by a tightening of supply and a resumption of liquidity-hunting momentum once it returns.

If that script repeats, it won’t just be BTC moving higher. When Bitcoin finds a base and pivots, it tends to pull high-conviction altcoins, early-stage infrastructure projects, and high-beta meme ecosystems up with it. The window before sentiment officially flips is usually when asymmetric bets hit hardest.

Against that backdrop, three very different plays are emerging as early beneficiaries of a potential rebound, a mix that fits neatly into the current search for the best crypto to buy now :

- Bitcoin Hyper (HYPER) — a high-speed Bitcoin Layer-2 narrative with real traction,

- PEPENODE ($PEPENODE) — a mine-to-earn ecosystem tapping into fresh meme-infrastructure crossover hype, and

- Shiba Inu — a maturing meme-turned-ecosystem that keeps picking up institutional validation.

1. Bitcoin Hyper ($HYPER) — First Bitcoin Layer 2 With SVM Speed

Bitcoin Hyper is pitching itself as the first true Bitcoin Layer 2, engineered to tackle three of Bitcoin’s biggest structural limitations in one shot: slow confirmations, high L1 fees during congestion, and the lack of native smart contracts.

The solution is a modular architecture that keeps Bitcoin L1 for settlement while shifting execution to a high-speed SVM-powered Layer 2.

Rather than forcing Bitcoin to behave like an all-purpose chain, $HYPER bolts Solana-grade performance onto Bitcoin’s security base.

By integrating the Solana Virtual Machine , developers can deploy fast, parallelized smart contracts that rival, and in some cases surpass, Solana on raw execution throughput, while still anchoring finality to Bitcoin.

SPL-compatible tokens port natively to the L2, lowering the friction for projects migrating from the Solana ecosystem.

For users, this opens the door to instant, low-fee payments in wrapped BTC, plus a full DeFi stack, swaps, lending markets, and staking protocols that Bitcoin has never supported natively.

NFT platforms, gaming projects, and high-throughput dApps can be built using a Rust-based SDK designed for teams already familiar with Solana tooling but who want Bitcoin’s monetary premium and credibility.

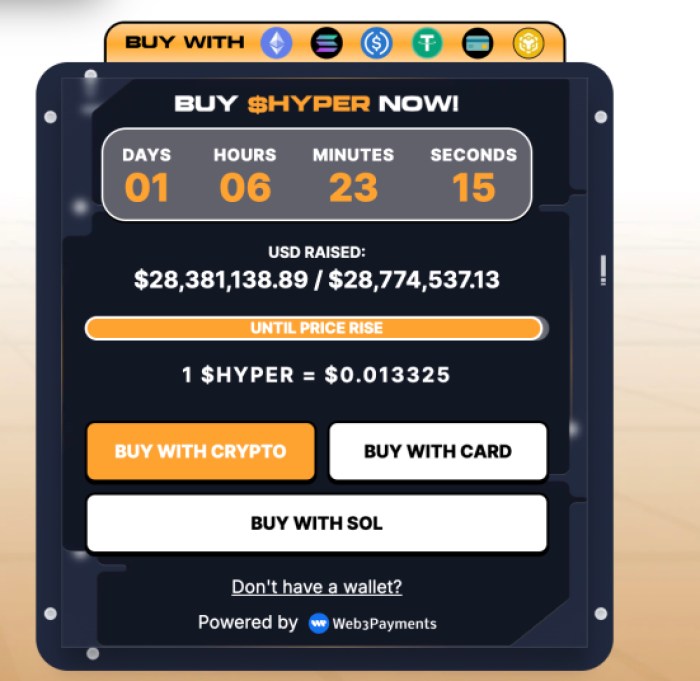

On the market side, demand has been unmistakable. The Bitcoin Hyper presale has crossed $28.5M raised, with tokens priced around $0.013335, putting it firmly on the radar of early infrastructure investors, especially those now searching for how to buy $HYPER before the next stage unlocks.

Two high-net-worth wallets accumulated roughly $396K in recent weeks, including a single $53K buy , the kind of early whale activity that typically signals conviction, not speculation.

Staking activates from TGE with high-APY rewards (41% currently), instant access for presale participants, and a short 7-day vesting window.

And for anyone still asking what Bitcoin Hyper is , the reward model is designed to scale with both capital staked and ecosystem participation, nudging holders toward long-term alignment rather than short-term flipping.

You can join the $HYPER presale here.

2. PEPENODE ($PEPENODE) — A Mine-to-Earn Memecoin Built on Node Economics

For investors who want meme exposure without relying purely on virality, PEPENODE takes a different route. It blends meme culture with mine-to-earn mechanics, giving holders an actual system to participate in rather than a passive buy-and-pray model.

Users operate virtual nodes, level them up, and earn tiered rewards based on engagement, creating a structure that feels closer to early Bitcoin mining culture, just gamified for the modern meme cycle.

The setup is simple but effective: a dashboard tracks your virtual mining activity, while a tiered node system determines how much of the emissions or rewards you capture.

Higher-tier nodes earn more, meaning early entry and consistent participation can potentially unlock larger upside. It’s a memecoin, but with a built-in engine that rewards activity instead of pure hype.

On the fundraising front, the presale has already pulled in over $2.2M, with tokens priced at $0.0011638, modest compared with major infrastructure plays but strong for a narrative-driven meme project still in distribution.

Our $PEPENODE price prediction suggests it could reach $0.0077 by the end of 2026 if the mine-to-earn narrative gains traction.

And with whales positioning for a broader market rebound, even small capital inflows into meme-adjacent experiments can trigger big percentage moves.

There’s no formal staking program yet, which makes PEPENODE a pure speculation and gamified-yield play rather than a yield-maximization platform. But that’s also the appeal: if mine-to-earn catches fire with retail during the next meme rotation, token prices don’t need to move far to generate outsized returns.

Explore the PEPENODE presale here.

3. Shiba Inu (SHIB) — A Meme Brand Turning Into a Full Web3 Stack

Shiba Inu (SHIB) may have launched as a pure meme, but it has steadily transformed into a broad Web3 ecosystem spanning DeFi, payments, and infrastructure. The backbone of that evolution is Shibarium, the project’s EVM-compatible Layer 2 designed for low-cost, high-throughput transactions.

By offloading activity from the Ethereum mainnet, Shibarium gives the Shiba ecosystem room to scale while preserving its connection to the wider EVM universe.

The ecosystem now stretches well beyond SHIB. Tokens like BONE, LEASH, and TREAT support governance, liquidity incentives, and additional utility layers, while ShibaSwap provides the DeFi foundation for swapping, liquidity pools, and yield tools.

A pipeline of privacy-enhanced smart contracts and broader Web3 modules adds to the long-term ambition: converting one of crypto’s largest communities into a functioning, self-sustaining platform.

For investors, that combination, a sticky global community, a working Layer 2, a growing dApp stack, and early ETF exposure, positions SHIB as a more conservative meme-side allocation compared with presale-stage tokens.

It may not move like a microcap, but it can serve as a solid satellite position if a broader altcoin rotation follows the whales’ $2B Bitcoin bet.

Learn more on the official Shiba Inu site.

Recap: Whales are leaning into a Bitcoin rebound, and that kind of conviction often flows into high-upside altcoins. Bitcoin Hyper , PEPENODE , and SHIB each tap a different part of that rotation, with the $HYPER and PEPENODE presales offering the most asymmetric early-stage opportunities while SHIB provides the steadier ecosystem angle. This article is for informational purposes only and does not constitute financial, investment, or trading advice; always do your own research. Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/news/best-crypto-to-buy-after-bitcoin-whale-2b-bet/