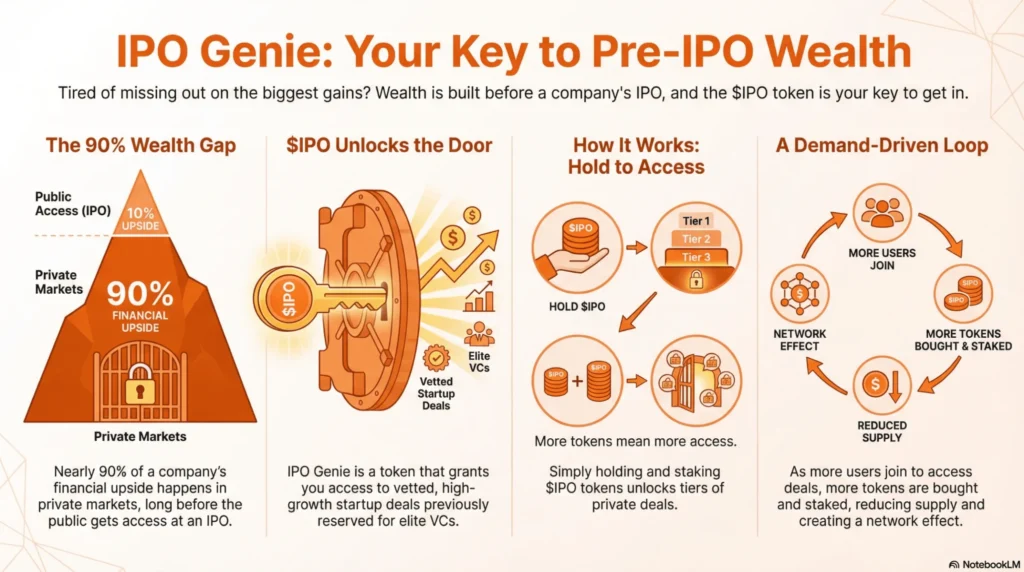

“Ever wonder why VCs get rich before you even hear about the deal?” That’s not bad timing. That’s the system. Retail investors usually show up at IPOs or exchange listings after nearly 90% of the upside is already gone . By then, early backers like Sequoia , Andreessen Horowitz , and insiders have done the heavy lifting. Think Uber , Airbnb , Stripe . Life-changing gains happened before the public ever got access.

Now zoom out to 2026. A fresh crypto cycle is forming. Private markets are moving on-chain. Real utility is finally replacing hype. This is where things get interesting.

“$IPO isn’t just another AI presale token of 2026, it’s a key to a market most people never touch.” A market where wealth is built early, quietly, and at scale. Let’s break down why IPO Genie ($IPO) could be one of the biggest high-upside opportunities of this cycle , before the crowd catches on.

What IPO Genie ($IPO) Actually Is?

IPO Genie ($IPO) is a private market access token built to break the old “1% vs 99%” investing rule.

For decades, the top 1% had early access to high-growth startups while the 99% waited for IPOs or public listings. By then, most of the upside was already gone. Not because retail investors were late, but because access was restricted by design.

$IPO changes that. When you hold $IPO , you unlock vetted startup and pre-IPO deals that are normally off-limits. No insider connections. No $250,000 minimum checks . No decade-long lockups that trap capital. You enter earlier, with flexibility built in.

The utility is clear and practical. Access to private deals. Priority allocations as demand grows. Rewards through staking and participation. Governance that lets holders influence decisions instead of just reacting to price charts.

Everything is designed to stay simple and investor-first. “Think ‘Uniswap for private markets’, but compliant and deal-driven.” That’s the shift. From waiting on the sidelines to getting in early.

How IPO Genie Unlocks Private Market Deals That Regular Investors Never See

Private investing was never about timing. It was about access . That is exactly what IPO Genie unlocks.

When you hold $IPO , you gain entry into curated startup and pre-IPO deals that usually stay behind closed networks. These opportunities do not appear randomly. IPO Genie uses AI-powered deal discovery to scan early-stage markets, analyze real data, and surface startups before they hit public radar.The system focuses on real signals like traction, market activity, team strength, and risk indicators. Not hype. Not social noise. Every deal then passes through multi-layer checks so only high-quality opportunities reach users.

This is where IPO Genie stands apart in web3 . Most public tokens move on sentiment and short-term narratives. Private startups grow quietly , driven by fundamentals long before charts exist. That is why many investors are calling $IPO the top AI presale token of 2026 .

Traditional VC remains closed, expensive, and slow . Long lockups and insider-only access. IPO Genie flips the model. Open access from $10. Exit anytime. Hold tokens, not paperwork.

$IPO is about access, not price guessing. It opens doors that were never meant to be public.

Why 2026 Is the Perfect Setup for $IPO

2026 is not about guessing tops or chasing noise. It is about positioning early .

Private markets are growing fast, while IPOs keep getting delayed. Companies stay private longer, raise more capital behind closed doors, and build most of their value before the public ever gets access. That shift changes where the upside lives.

Now look at what is happening underneath.

Tokenization + regulation clarity = real adoption

This is the turning point. Tokenized assets are no longer an experiment. Clearer rules and stronger infrastructure are pushing real capital on-chain. Not promises. Not test phases. Real participation.

Multiple industry studies already point to 2026 as a breakout year for AI and crypto convergence . Forecasts from global research firms show AI-driven platforms and tokenized assets moving from pilots to production at scale. That timing matters. Infrastructure gets built first. Value follows.

Investor behavior is shifting, too. Crypto capital is moving away from pure hype and toward cash flow, ownership, and early access .

Institutions are already positioning capital into tokenized real-world assets. They are building exposure quietly as private markets expand, IPO timelines stretch, and tokenization reaches maturity under clearer regulatory frameworks. Together, these shifts point to 2026 as a defining moment. “This isn’t early 2021 AI tokens speculation. This is early infrastructure.”

The Math Everyone Cares About: What If $IPO Does a 1000x?

Let’s keep this practical. At the time of writing, $IPO is priced at $0.00011740 per token .

A $1,000 investment gets you roughly 8.52 million $IPO tokens .

Now factor in the incentives.IPO Genie currently offers a 20% welcome bonus on purchases. That alone boosts your allocation to 10.22 million tokens . Add the 15% referral bonus , and your total holdings climb to 11.75 million $IPO for the same $1,000.

Now let’s look at upside scenarios.

-

At 100x

($0.0117 per $IPO)

Your position is worth $137,000 -

At 500x

($0.0587 per $IPO)

Your position grows to $687,000 -

At 1000x

($0.1174 per $IPO)

Your $1,000 becomes $1.37 million

That’s the power of early pricing plus the bonus mechanics of this top crypto presale .

A 1000x sounds extreme, but starting from a low base changes the equation . At those levels, $IPO would still sit below the peak market caps reached by major crypto infrastructure platforms.

The upside here is not driven by hype. It’s tied to platform adoption, deal access demand, staking lockups, and private market participation .

“This isn’t a meme moonshot. It’s a utility-driven upside built on access.”

What Actually Drives $IPO Price Higher (Demand Loops)

Price does not move on hope. It moves on demand .

With $IPO, demand starts with access tiers . The more $IPO you hold, the more deals you unlock. That creates natural buying pressure. People do not buy for speculation. They buy because access requires it.

Then comes staking . When holders stake $IPO to secure allocations, earn rewards, or unlock benefits, those tokens leave circulation. Less supply on the market changes the balance. That matters over time.

The platform itself drives usage. More deals mean more activity . Every startup listed, every allocation made, and every reward distributed increases real interaction with the token. This is not passive utility. It is in constant use.

The network effect compounds it.

More deals → more users → more $IPO locked

That loop feeds itself. This is where $IPO separates from empty utility tokens. Many promise features that never get used. IPO Genie ties its token directly to participation. No token, no access. That is why the logic stays simple.

“Price follows access, not promises.” And access only grows as the platform scales.

Why Early Access Tokens Like $IPO Create Real Wealth

The idea is simple. You risk a small amount, but the upside is not capped. That only happens when you enter early.

Early access beats late liquidity. When most people buy after listings and hype, the upside is already priced in. With early access tokens, the balance shifts. The downside stays limited to entry. The upside grows as adoption builds.

That is the difference between buying hype tokens late and owning infrastructure tokens early. Hype tokens depend on attention. Infrastructure tokens grow through usage. As platforms expand, access tightens, and demand follows.

$IPO fits this model. It operates as an AI presale token tied to real access, staking demand, and platform activity. Usage comes first. Price follows later. Wealth isn’t made when everyone agrees. It’s made when access is still limited.

The Window Is Closing

Early opportunities don’t announce themselves loudly. They tighten quietly.With IPO Genie ($IPO) , pricing has already started moving up as access expands and demand builds. Each new phase raises the bar. Bonuses shrink. Early entry gets harder. That’s how real platforms grow.

This AI presale token sits in that brief moment where access still feels open, but momentum is clearly forming. Private markets are moving on-chain. AI is reshaping deal discovery. Infrastructure is getting priced before adoption goes mainstream.

By the time everyone agrees this makes sense, the opportunity will look very different. If you’re reading this now, you’re early. The only question left is how long you plan to stay on the sidelines .

Join the IPO Genie’s Presale Now

Website

Presale

Telegram

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments carry risk, and readers should conduct their own research before participating.