The post Bitcoin Options Expiry Today: $3 Billion BTC and ETH Contracts Set to Trigger Volatility appeared first on Coinpedia Fintech News

The crypto market today is going to see strong volatility as bitcoin options expiry and ethereum options expiry bring nearly $3 billion worth of contracts to an end on the Deribit exchange.

This major crypto options expiry represents close to 9% of total open interest, making it a key event for short-term price action.

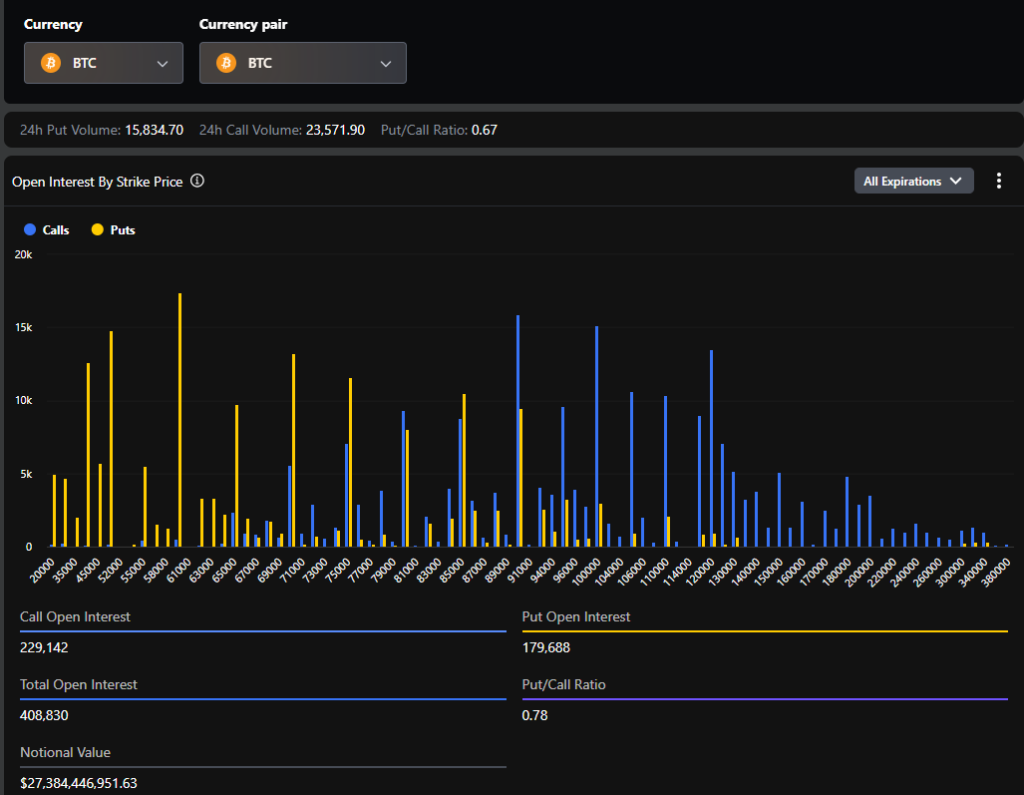

Bitcoin Options Expiry To Sees $2.5 Billion

According to Deribit’s latest data, the bitcoin options expiry included around 38,000 contracts with a total value of nearly $2.5 billion.

The put-call ratio stands at 0.71, showing that traders are taking a balanced view rather than betting heavily in one direction. The BTC max pain level is at $74,000, while Bitcoin traded near $66,872.

The Bitcoin option expiry chart shows rising caution in the market, especially as Bitcoin continues to struggle to move back above the $70,000 level.

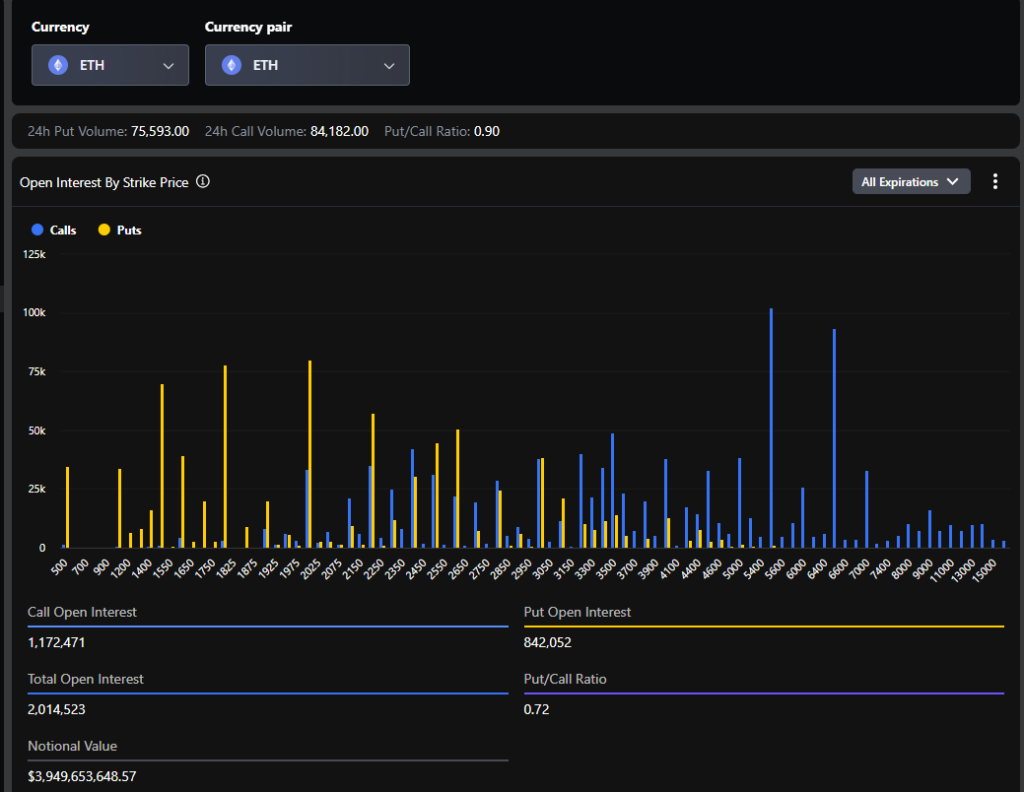

Ethereum Options Expiry Adds Pressure With $410 Million

Alongside Bitcoin, the ethereum options expiry covered about 215,000 contracts worth roughly $410 million. However, the ETH “max pain” level sits around $2,100, while the current price is near $1,950 .

The put-call ratio is close to 0.82, which shows many traders are still protecting against further downside.

How the Crypto Market will React

This week’s expiry is larger than last week’s event, when a notable bitcoin options expiry saw about $2.1 billion worth of BTC contracts settle. During that expiry, Bitcoin’s price moved by around 2%, showing only a limited short-term impact.

Historically, expiries of this size can slightly influence short-term price moves, but markets often stabilize once positions are settled.

Now, with Bitcoin trading near $66,891 and Ethereum around $1,985, the market could see short bursts of volatility again as open interest unwinds.