DeFi YAM,一行代码如何蒸发数亿美元?

本文来源: 慢雾科技

作者 : yudan @ 慢雾安全团队

前言

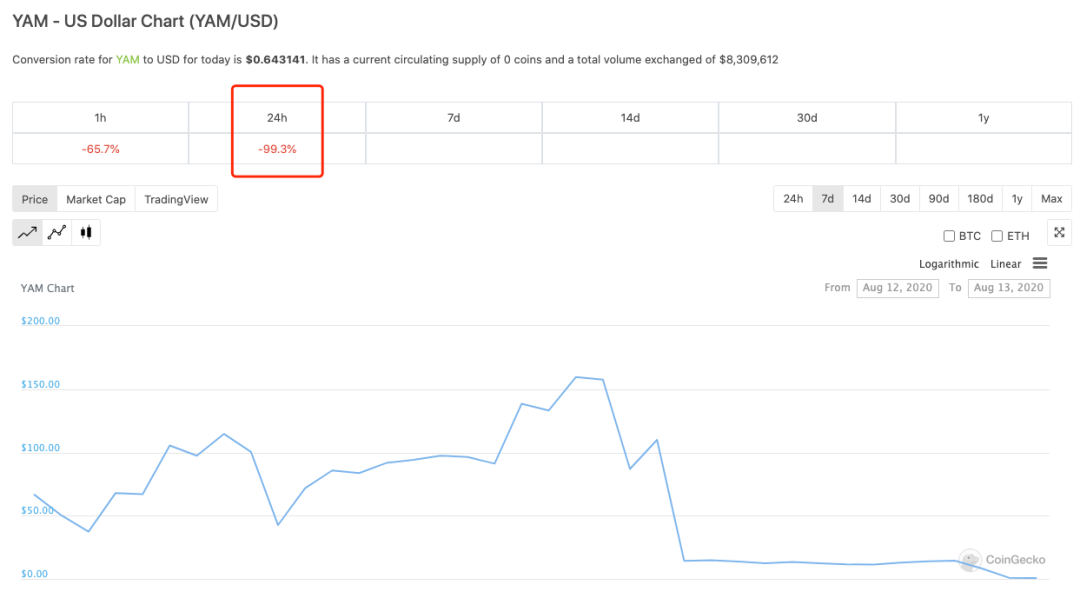

据链闻消息,2020 年 8 月 13 日,知名以太坊 DeFi 项目 YAM 官方通过 Twitter 发文表明发现合约中存在漏洞,24 小时内价格暴跌 99% 。慢雾安全团队在收到情报后快速进行了相关的跟进及分析,以下是详细的技术细节。

发生了什么?

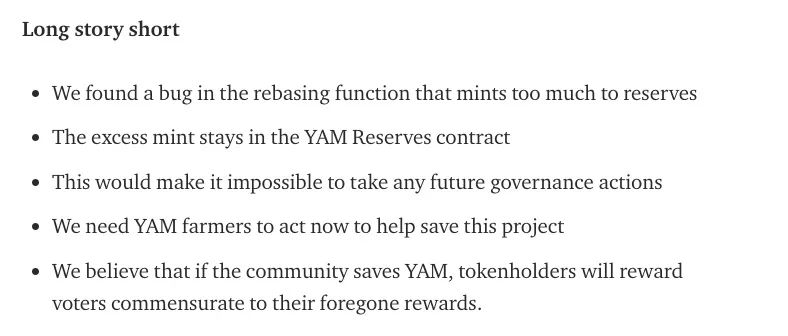

以上是 YAM 官方对本次事件的简短说明(来源: https://medium.com/@yamfinance/save-yam-245598d81cec )。

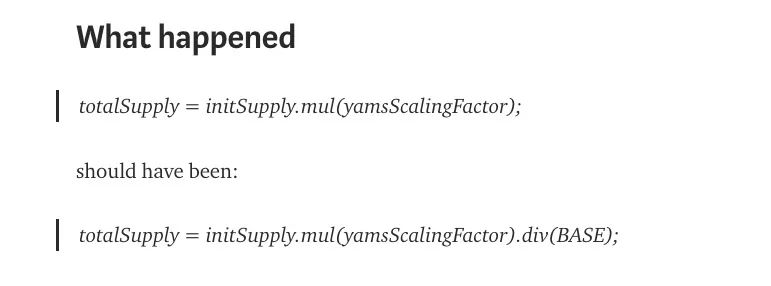

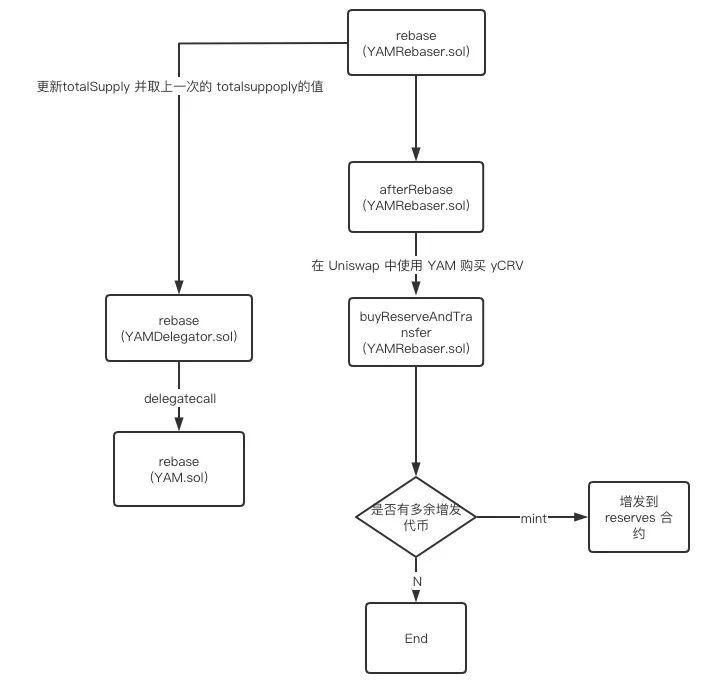

简单来说就是官方在合约中发现负责调整供应量的函数发生了问题,这个问题导致多余的 YAM 代币放进了 YAM 的 reserves 合约中,并且如果不修正这个问题,将会导致 YAM 的后续治理变为不可能。同时,官方给出了此次漏洞的具体问题代码,如下:

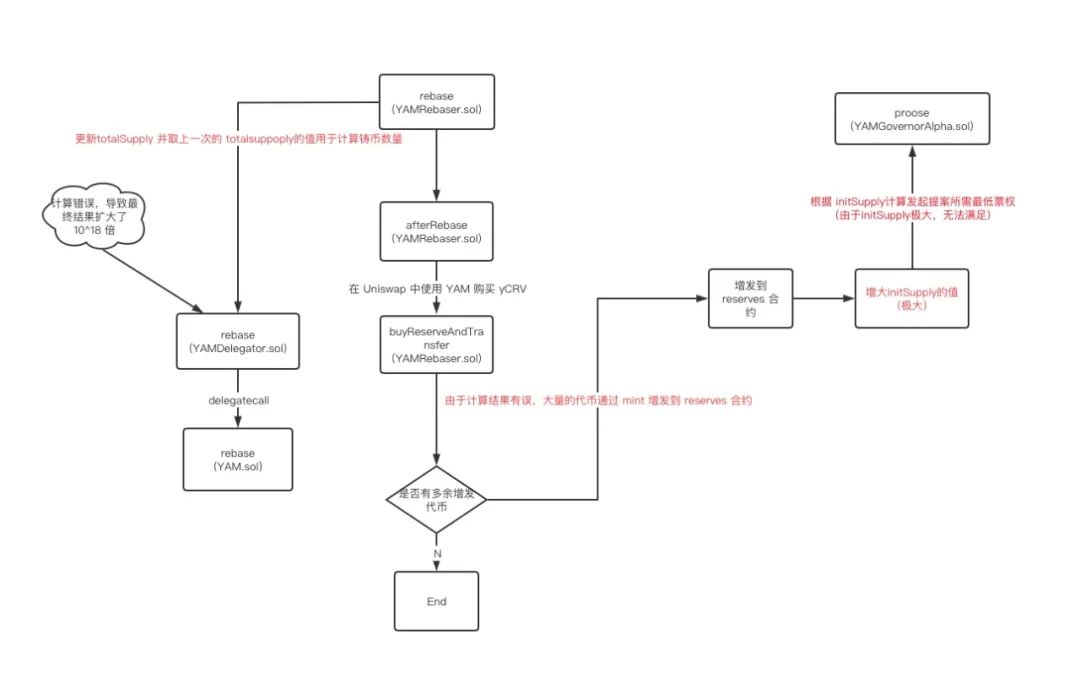

从上图可知,由于编码不规范,YAM 合约在调整 totalSupply 的时候,本应将最后的结果除以 BASE 变量,但是在实际开发过程中却忽略了,导致 totoalSupply 计算不正确,比原来的值要大 10^18 倍。但是代币供应量问题和治理是怎么扯上关系呢?这需要我们针对代码做进一步的分析。

YAM 会变成怎样?

为了深入了解此次漏洞造成的影响,需要对 YAM 项目代码进行深入的了解。根据官方给出的问题代码及项目 Github 地址( https://github.com/yam-finance/yam-protocol ),可以定位出调整供应量的 rebase 函数位于 YAMDelegator.sol 合约中,具体代码如下:

function rebase(

uint256 epoch,

uint256 indexDelta,

bool positive

)

external

returns (uint256)

{

epoch; indexDelta; positive;

delegateAndReturn();

}

function delegateAndReturn() private returns (bytes memory) {

(bool success, ) = implementation.delegatecall(msg.data); assembly {

let free_mem_ptr := mload(0x40)

returndatacopy(free_mem_ptr, 0, returndatasize)

switch success

case 0 { revert(free_mem_ptr, returndatasize) }

default { return(free_mem_ptr, returndatasize) }

}

}

function rebase(

uint256 epoch,

uint256 indexDelta,

bool positive

)

external

onlyRebaser

returns (uint256)

{

if (indexDelta == 0) {

emit Rebase(epoch, yamsScalingFactor, yamsScalingFactor);

return totalSupply;

} uint256 prevYamsScalingFactor = yamsScalingFactor;

if (!positive) {

yamsScalingFactor = yamsScalingFactor.mul(BASE.sub(indexDelta)).div(BASE);

} else {

uint256 newScalingFactor = yamsScalingFactor.mul(BASE.add(indexDelta)).div(BASE);

if (newScalingFactor < _maxScalingFactor()) {

yamsScalingFactor = newScalingFactor;

} else {

yamsScalingFactor = _maxScalingFactor();

}

}

//SlowMist// 问题代码

totalSupply = initSupply.mul(yamsScalingFactor);

emit Rebase(epoch, prevYamsScalingFactor, yamsScalingFactor);

return totalSupply;

}

}

分析到这里还没结束,要将漏洞和社区治理关联起来,需要对代码进行进一步的分析。通过观察 rebase 函数的修饰器,不难发现此处限定了只能是 rebaser 进行调用。而 rebaser 是 YAM 中用与实现供应量相关逻辑的合约,也就是说,是 rebaser 合约最终调用了 YAM.sol 合约中的 rebase 函数。通过跟踪相关代码,发现 rebaser 合约中对应供应量调整的逻辑为 rebase 函数,代码如下:

function rebase()

public

{

// EOA only

require(msg.sender == tx.origin);

// ensure rebasing at correct time

_inRebaseWindow(); // This comparison also ensures there is no reentrancy.

require(lastRebaseTimestampSec.add(minRebaseTimeIntervalSec) < now);

// Snap the rebase time to the start of this window.

lastRebaseTimestampSec = now.sub(

now.mod(minRebaseTimeIntervalSec)).add(rebaseWindowOffsetSec);

epoch = epoch.add(1);

// get twap from uniswap v2;

uint256 exchangeRate = getTWAP();

// calculates % change to supply

(uint256 offPegPerc, bool positive) = computeOffPegPerc(exchangeRate);

uint256 indexDelta = offPegPerc;

// Apply the Dampening factor.

indexDelta = indexDelta.div(rebaseLag);

YAMTokenInterface yam = YAMTokenInterface(yamAddress);

if (positive) {

require(yam.yamsScalingFactor().mul(uint256(10**18).add(indexDelta)).div(10**18) < yam.maxScalingFactor(), "new scaling factor will be too big");

}

//SlowMist// 取当前 YAM 代币的供应量

uint256 currSupply = yam.totalSupply();

uint256 mintAmount;

// reduce indexDelta to account for minting

//SlowMist// 计算要调整的供应量

if (positive) {

uint256 mintPerc = indexDelta.mul(rebaseMintPerc).div(10**18);

indexDelta = indexDelta.sub(mintPerc);

mintAmount = currSupply.mul(mintPerc).div(10**18);

}

// rebase

//SlowMist// 调用 YAM 的rebase 逻辑

uint256 supplyAfterRebase = yam.rebase(epoch, indexDelta, positive);

assert(yam.yamsScalingFactor() <= yam.maxScalingFactor());

// perform actions after rebase

//SlowMist// 进入调整逻辑

afterRebase(mintAmount, offPegPerc);

}

function afterRebase(

uint256 mintAmount,

uint256 offPegPerc

)

internal

{

// update uniswap

UniswapPair(uniswap_pair).sync();

//SlowMist// 通过 uniswap 购买 yCRV 代币

if (mintAmount > 0) {

buyReserveAndTransfer(

mintAmount,

offPegPerc

);

} // call any extra functions

//SlowMist// 社区管理调用

for (uint i = 0; i < transactions.length; i++) {

Transaction storage t = transactions[i];

if (t.enabled) {

bool result =

externalCall(t.destination, t.data);

if (!result) {

emit TransactionFailed(t.destination, i, t.data);

revert("Transaction Failed");

}

}

}

}

function buyReserveAndTransfer(

uint256 mintAmount,

uint256 offPegPerc

)

internal

{

UniswapPair pair = UniswapPair(uniswap_pair); YAMTokenInterface yam = YAMTokenInterface(yamAddress);

// get reserves

(uint256 token0Reserves, uint256 token1Reserves, ) = pair.getReserves();

// check if protocol has excess yam in the reserve

uint256 excess = yam.balanceOf(reservesContract);

//SlowMist// 计算用于 Uniswap 中兑换的 YAM 数量

uint256 tokens_to_max_slippage = uniswapMaxSlippage(token0Reserves, token1Reserves, offPegPerc);

UniVars memory uniVars = UniVars({

yamsToUni: tokens_to_max_slippage, // how many yams uniswap needs

amountFromReserves: excess, // how much of yamsToUni comes from reserves

mintToReserves: 0 // how much yams protocol mints to reserves

});

// tries to sell all mint + excess

// falls back to selling some of mint and all of excess

// if all else fails, sells portion of excess

// upon pair.swap, `uniswapV2Call` is called by the uniswap pair contract

if (isToken0) {

if (tokens_to_max_slippage > mintAmount.add(excess)) {

// we already have performed a safemath check on mintAmount+excess

// so we dont need to continue using it in this code path

// can handle selling all of reserves and mint

uint256 buyTokens = getAmountOut(mintAmount + excess, token0Reserves, token1Reserves);

uniVars.yamsToUni = mintAmount + excess;

uniVars.amountFromReserves = excess;

// call swap using entire mint amount and excess; mint 0 to reserves

pair.swap(0, buyTokens, address(this), abi.encode(uniVars));

} else {

if (tokens_to_max_slippage > excess) {

// uniswap can handle entire reserves

uint256 buyTokens = getAmountOut(tokens_to_max_slippage, token0Reserves, token1Reserves);

// swap up to slippage limit, taking entire yam reserves, and minting part of total

//SlowMist// 将多余代币铸给 reserves 合约

uniVars.mintToReserves = mintAmount.sub((tokens_to_max_slippage - excess));

//SlowMist// Uniswap代币交换

pair.swap(0, buyTokens, address(this), abi.encode(uniVars));

} else {

// uniswap cant handle all of excess

uint256 buyTokens = getAmountOut(tokens_to_max_slippage, token0Reserves, token1Reserves);

uniVars.amountFromReserves = tokens_to_max_slippage;

uniVars.mintToReserves = mintAmount;

// swap up to slippage limit, taking excess - remainingExcess from reserves, and minting full amount

// to reserves

pair.swap(0, buyTokens, address(this), abi.encode(uniVars));

}

}

} else {

if (tokens_to_max_slippage > mintAmount.add(excess)) {

// can handle all of reserves and mint

uint256 buyTokens = getAmountOut(mintAmount + excess, token1Reserves, token0Reserves);

uniVars.yamsToUni = mintAmount + excess;

uniVars.amountFromReserves = excess;

// call swap using entire mint amount and excess; mint 0 to reserves

pair.swap(buyTokens, 0, address(this), abi.encode(uniVars));

} else {

if (tokens_to_max_slippage > excess) {

// uniswap can handle entire reserves

uint256 buyTokens = getAmountOut(tokens_to_max_slippage, token1Reserves, token0Reserves);

// swap up to slippage limit, taking entire yam reserves, and minting part of total

//SlowMist// 增发的多余的代币给 reserves 合约

uniVars.mintToReserves = mintAmount.sub( (tokens_to_max_slippage - excess));

// swap up to slippage limit, taking entire yam reserves, and minting part of total

//Slowist// 在 uniswap 中进行兑换,并最终调用 rebase 合约的 uniswapV2Call 函数

pair.swap(buyTokens, 0, address(this), abi.encode(uniVars));

} else {

// uniswap cant handle all of excess

uint256 buyTokens = getAmountOut(tokens_to_max_slippage, token1Reserves, token0Reserves);

uniVars.amountFromReserves = tokens_to_max_slippage;

uniVars.mintToReserves = mintAmount;

// swap up to slippage limit, taking excess - remainingExcess from reserves, and minting full amount

// to reserves

pair.swap(buyTokens, 0, address(this), abi.encode(uniVars));

}

}

}

}

function uniswapV2Call(

address sender,

uint256 amount0,

uint256 amount1,

bytes memory data

)

public

{

// enforce that it is coming from uniswap

require(msg.sender == uniswap_pair, "bad msg.sender");

// enforce that this contract called uniswap

require(sender == address(this), "bad origin");

(UniVars memory uniVars) = abi.decode(data, (UniVars)); YAMTokenInterface yam = YAMTokenInterface(yamAddress);

if (uniVars.amountFromReserves > 0) {

// transfer from reserves and mint to uniswap

yam.transferFrom(reservesContract, uniswap_pair, uniVars.amountFromReserves);

if (uniVars.amountFromReserves < uniVars.yamsToUni) { // if the amount from reserves > yamsToUni, we have fully paid for the yCRV tokens

// thus this number would be 0 so no need to mint

yam.mint(uniswap_pair, uniVars.yamsToUni.sub(uniVars.amountFromReserves));

}

} else {

// mint to uniswap

yam.mint(uniswap_pair, uniVars.yamsToUni);

}

// mint unsold to mintAmount

//SlowMist// 将多余的 YAM 代币分发给 reserves 合约

if (uniVars.mintToReserves > 0) {

yam.mint(reservesContract, uniVars.mintToReserves);

}

// transfer reserve token to reserves

if (isToken0) {

SafeERC20.safeTransfer(IERC20(reserveToken), reservesContract, amount1);

emit TreasuryIncreased(amount1, uniVars.yamsToUni, uniVars.amountFromReserves, uniVars.mintToReserves);

} else {

SafeERC20.safeTransfer(IERC20(reserveToken), reservesContract, amount0);

emit TreasuryIncreased(amount0, uniVars.yamsToUni, uniVars.amountFromReserves, uniVars.mintToReserves);

}

}

也就是说,每次的 rebase ,如果有多余的 YAM 代币,这些代币将会流到 reserves 合约中,那这和社区治理的关系是什么呢?

通过分析项目代码,发现治理相关的逻辑在 YAMGovernorAlpha.sol 中,其中发起提案的函数为 propose,具体代码如下:

function propose(

address[] memory targets,

uint[] memory values,

string[] memory signatures,

bytes[] memory calldatas,

string memory description

)

public

returns (uint256)

{ //SlowMist// 校验提案发起者的票数占比

require(yam.getPriorVotes(msg.sender, sub256(block.number, 1)) > proposalThreshold(), "GovernorAlpha::propose: proposer votes below proposal threshold");

require(targets.length == values.length && targets.length == signatures.length && targets.length == calldatas.length, "GovernorAlpha::propose: proposal function information arity mismatch");

require(targets.length != 0, "GovernorAlpha::propose: must provide actions");

require(targets.length <= proposalMaxOperations(), "GovernorAlpha::propose: too many actions"); uint256 latestProposalId = latestProposalIds[msg.sender];

if (latestProposalId != 0) {

ProposalState proposersLatestProposalState = state(latestProposalId);

require(proposersLatestProposalState != ProposalState.Active, "GovernorAlpha::propose: one live proposal per proposer, found an already active proposal");

require(proposersLatestProposalState != ProposalState.Pending, "GovernorAlpha::propose: one live proposal per proposer, found an already pending proposal");

}

uint256 startBlock = add256(block.number, votingDelay());

uint256 endBlock = add256(startBlock, votingPeriod());

proposalCount++;

Proposal memory newProposal = Proposal({

id: proposalCount,

proposer: msg.sender,

eta: 0,

targets: targets,

values: values,

signatures: signatures,

calldatas: calldatas,

startBlock: startBlock,

endBlock: endBlock,

forVotes: 0,

againstVotes: 0,

canceled: false,

executed: false

});

proposals[newProposal.id] = newProposal;

latestProposalIds[newProposal.proposer] = newProposal.id;

emit ProposalCreated(

newProposal.id,

msg.sender,

targets,

values,

signatures,

calldatas,

startBlock,

endBlock,

description

);

return newProposal.id;

}

function proposalThreshold() public view returns (uint256) {

return SafeMath.div(yam.initSupply(), 100); } // 1% of YAM

function mint(address to, uint256 amount)

external

onlyMinter

returns (bool)

{

_mint(to, amount);

return true;

} function _mint(address to, uint256 amount)

internal

{

// increase totalSupply

totalSupply = totalSupply.add(amount);

// get underlying value

uint256 yamValue = amount.mul(internalDecimals).div(yamsScalingFactor);

// increase initSupply

initSupply = initSupply.add(yamValue);

// make sure the mint didnt push maxScalingFactor too low

require(yamsScalingFactor <= _maxScalingFactor(), "max scaling factor too low");

// add balance

_yamBalances[to] = _yamBalances[to].add(yamValue);

// add delegates to the minter

_moveDelegates(address(0), _delegates[to], yamValue);

emit Mint(to, amount);

}

现在,我们已经分析完所有的流程了,剩下的就是把所有的分析串起来,看看这次的漏洞对 YAM 产生了什么影响,对上文的流程图做拓展,变成下面这样:

整个事件的分析如上图,由于 rebase 的时候取的是上一次的 totalSupply 的值,所以计算错误的 totalSupply 的值并不会立即通过 mint 作用到 initSupply 上,所以在下一次 rebase 前,社区仍有机会挽回这个错误,减少损失。但是一旦下一次 rebase 执行,整个失误将会变得无法挽回。

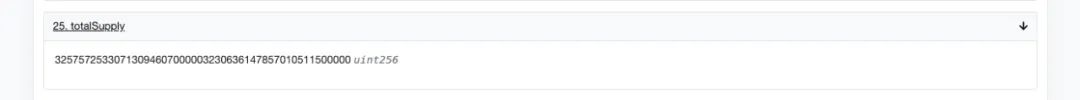

通过查询 Etherscan 上 YAM 代币合约的相关信息,可以看到 totalSupply 已经到了一个非常大的值,而 initSupply 还未受到影响。

前车之鉴

这次事件中官方已经给出了具体的修复方案,这里不再赘述。这次的事件充分暴露了未经审计 DeFi 合约中隐藏的巨大风险,虽然 YAM 开发者已经在 Github 中表明 YAM 合约的很多代码是参考了经过充分审计的 DeFi 项目如 Compound、Ampleforth、Synthetix 及 YEarn/YFI,但是仍无可避免地发生了意料之外的风险。

DeFi 项目 Yam Finance(YAM) 核心开发者 belmore 在推特上表示:“对不起,大家。我失败了。谢谢你们今天的大力支持。我太难过了。”,但是覆水已经难收,在此,慢雾安全团队给出如下 建议 :

1、由于 DeFi 合约的高度复杂性,任何 DeFi 项目都需在经过专业的安全团队充分审计后再进行上线,降低合约发生意外的风险 。 审计可联系慢雾安全团队([email protected])

2、项目中去中心化治理应循序渐进,在项目开始阶段,需要设置适当的权限以防发生黑天鹅事件。

【链向FM】以太坊基金会发起关于“支持Rollup发展”的社区捐款,Yam Finance官推发文疑似预告uSTONKS指数合约即将上线

据livebitcoinnews消息,针对此前达拉斯小牛队宣布接受狗狗币(Dogecoin)用于购买与该队有关的门票和商品,亿万富翁、Galaxy Digital创始人Mike Novogratz表示...

金色DeFi日报 | YAM将被列为UMA平台抵押资产

DeFi数据:1.DeFi总市值:805.61亿美元;2.过去24小时去中心化交易所的交易量:23.4亿美元;3.DeFi借贷平台借款总量:69.1亿美元;4.DeFi中锁定资产:417.4亿美元。

DeFi之道丨红薯(Yam)发布2021发展路线图,启动投资产品 YDS 和孵化器 Yam Factory

红薯(Yam)的2021年发展路线图已经出炉,看看有哪些新鲜的。...