Bitcoin Binary CDD Hints At Healthy Consolidation, Not A Top

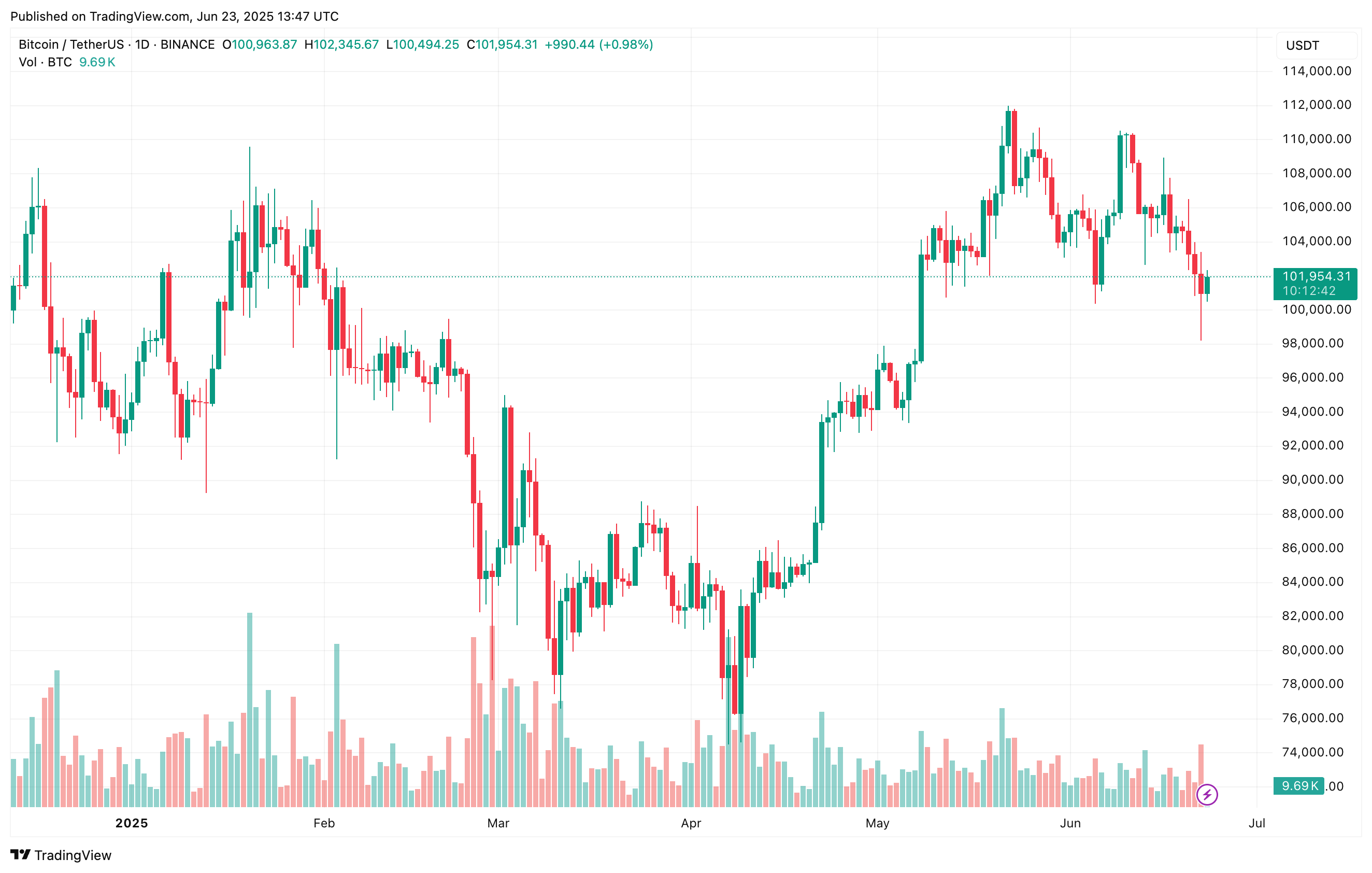

After a brief drop to $98,000 over the weekend, Bitcoin (BTC) has recovered and is now trading above $101,000 at the time of writing. While concerns about a potential double top persist, on-chain data has yet to show any major warning signs.

Bitcoin Undergoing Healthy Consolidation

According to a recent CryptoQuant Quicktake post by contributor Avocado_onchain, despite broader market sentiment turning bearish, BTC has not yet displayed any significant red flags. In fact, the cryptocurrency still appears to be in a consolidation phase.

Notably, the 30-day moving average (MA) of Binary Coin Days Destroyed (CDD) indicates that long-term holders are continuing to hold onto their BTC rather than selling. This suggests that investors remain optimistic about Bitcoin’s potential for further upside in the near term.

For the uninitiated, the 30-day MA Binary CDD smooths out daily fluctuations to show how frequently long-term Bitcoin holders are moving their coins over a month. A lower value suggests strong holding behavior and accumulation, while a higher value may indicate distribution or selling pressure from experienced holders.

The analyst noted in a previous analysis that when Bitcoin’s Binary CDD exceeded 0.8, it was typically followed by a steep correction. However, this time, the indicator has peaked around 0.6 and is now on the decline – suggesting the market is far from overheating. They added:

Although the data may not align perfectly from cycle to cycle, this moderation below 0.8 still implies the market may be entering a consolidation period, and further price or time correction could follow.

The analyst emphasized that this indicator does not signal the end of the bull run. Rather – similar to the previous two market phases – Bitcoin could be following a “staircase-like movement,” where periods of consolidation are followed by a strong upward leg.

They concluded that BTC historically tends to rally when market attention fades and sentiment remains quiet. Therefore, the current period of low volatility could be a precursor to Bitcoin’s next major move to the upside.

Are BTC Bears In Trouble?

While the current bearish sentiment may have raised hopes for further price pullback for the largest cryptocurrency by reported market cap, both technical and on-chain indicators suggest otherwise.

For example, short positions have been rising sharply within the $100,000–$110,000 range, increasing the likelihood of a short squeeze – which could drive BTC to a new all-time high (ATH).

That said, some caution is warranted, as short-term holders have been selling during recent dips, showing a lack of confidence in Bitcoin’s ability to sustain its upward trajectory. At press time, BTC trades at $101,954, up 1.1% in the past 24 hours.

Israel, Iran Ceasefire Ignites Crypto Surge As Bitcoin Tops $106,000—Details

An unexpected peace in the Middle East created waves in the crypto market on 24th June, 2025. Iran a...

Dogecoin About To Explode? ‘Don’t Send It Too Hard,’ Analyst Warns

The news that Iran and Israel have agreed to a ceasefire brokered by US President Donald Trump may h...

Is Ethereum Staging A Repeat Of 2021? Here’s Why A 200% Surge Could Follow

Ethereum saw a notable decline in its price over the last week, and the weekend culmination pulled t...