Bitcoin Lockdown: 14 Million BTC Now In Cold Storage As Holders Dig In

According to on-chain analytics firm Glassnode , more than 14 million Bitcoin have sat idle in wallets with little to no spending history. That leaves only about 7 million BTC out of the total 21 million supply ready for trading. This shift points to a growing number of holders who prefer long-term storage over quick trades.

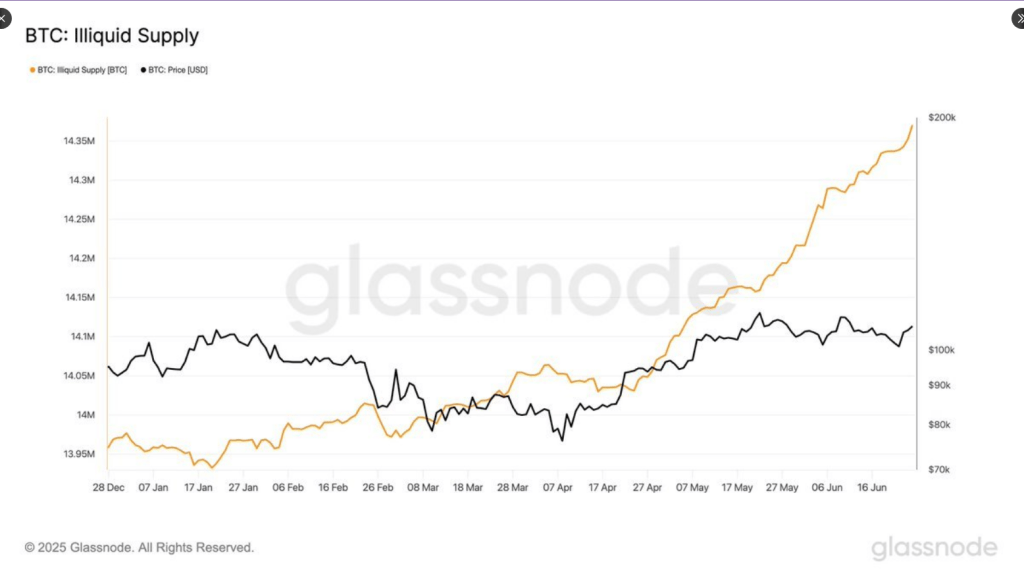

Steep Rise In Illiquid Bitcoin

Based on reports, the illiquid supply of Bitcoin climbed from just under 14 million in December 2024—when Bitcoin first broke the $100K mark—to roughly 14.30 million today. Demand for cold storage and self-custody solutions has never been higher.

Investors are moving coins off exchanges and into private wallets. That trend has been especially sharp since late March, even though price swings have stayed volatile.

Bitcoin’s illiquid supply just crossed 14 million $BTC

More and more holders are pulling coins off exchanges choosing cold storage over quick trades.

The message is clear: conviction is growing, and they’re here for the long haul. #Bitcoin #BTC #CryptoHODL pic.twitter.com/bQozg31mBK

— Erica Hazel (@Erica__Hazel) June 26, 2025

Corporate Buyers Ramp Up Holdings

In just the past week, more than five companies announced new Bitcoin purchases. ProCap BTC led the way with two buys: 3,724 BTC for $387 million and 1,208 BTC for $128 million, adding up to 4,930 BTC worth $515 million.

Michael Saylor’s Strategy added 245 BTC after spending $1 billion the week before. Smarter Web picked up 197 BTC, while Méliuz S.A. acquired 275 BTC, taking its total to 596 BTC.

The Blockchain Group chipped in with 75 BTC, bringing its haul to 1,728 BTC. Most recently, Metaplanet spent around $132 million on 1,234 BTC, lifting its total Bitcoin stash to 12,345 BTC purchased for about $1.20 billion.

Supply Numbers Tighten

Supply Numbers Tighten

Only one-third of Bitcoin’s fixed supply remains “liquid,” meaning it’s likely to trade hands. That squeeze could make it harder for new buyers to find inventory.

Over-the-counter desks and exchange order books report thinner BTC listings. When institutions can’t source coins as easily, they may bid prices higher.

On-chain metrics can’t tell us why coins are unmoved—some may be lost forever—but the uptick in self-custody transfers shows real demand.

Forecasts Suggest Price Pressure AheadAt Bitcoin Conference 2025 , Eric Trump predicted that he believes BTC will hit $170K at the end of 2026. He pointed out that the number of firms with Bitcoin has doubled in the last year.

But if a supply crunch is matched with steady or increasing demand, prices might experience a strong push higher. Yet markets may remain unpredictable. Unexpected sell-offs or macro shocks can turn the trend around quicker than anyone can imagine.

Investors and analysts will be monitoring the pace of new entrants into the market. For the time being, a record 14.35 million Bitcoin are sleeping idle, and that constricted supply may lay the groundwork for the next great rally.

Featured image from Unsplash, chart from TradingView

Bitcoin Gets The Greenlight To Be Counted As Assets For Mortgage Applications, But What About XRP?

A major breakthrough has just arrived for Bitcoin and the crypto industry from one of the most influ...

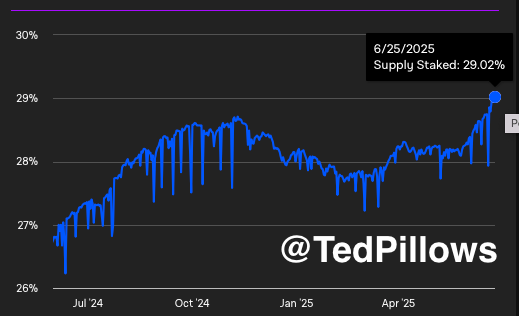

Ethereum Staking Hits Record High: 29.02% Of Supply Locked Signals Long-Term Conviction

Ethereum is trading at a critical level after reclaiming the $2,400 mark, showing resilience in the ...

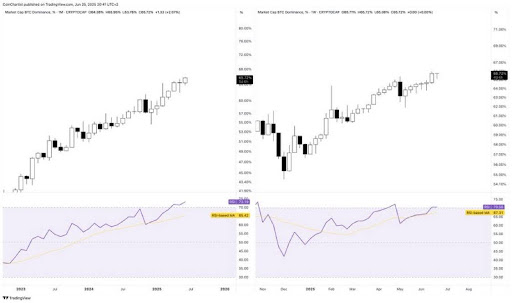

Bitcoin Dominance Holds Altcoin Season At Bay, Analyst Says No Upside Until This Happens

The Bitcoin Dominance (BTC.D) continues to exert pressure on the broader crypto market, casting a sh...